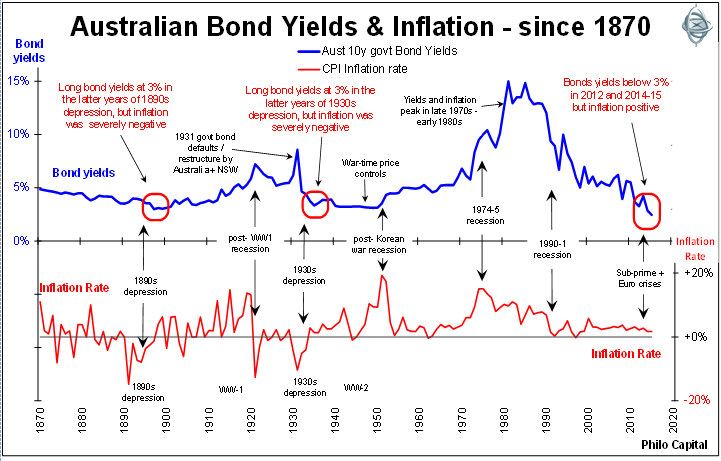

Australian bond yields and inflation

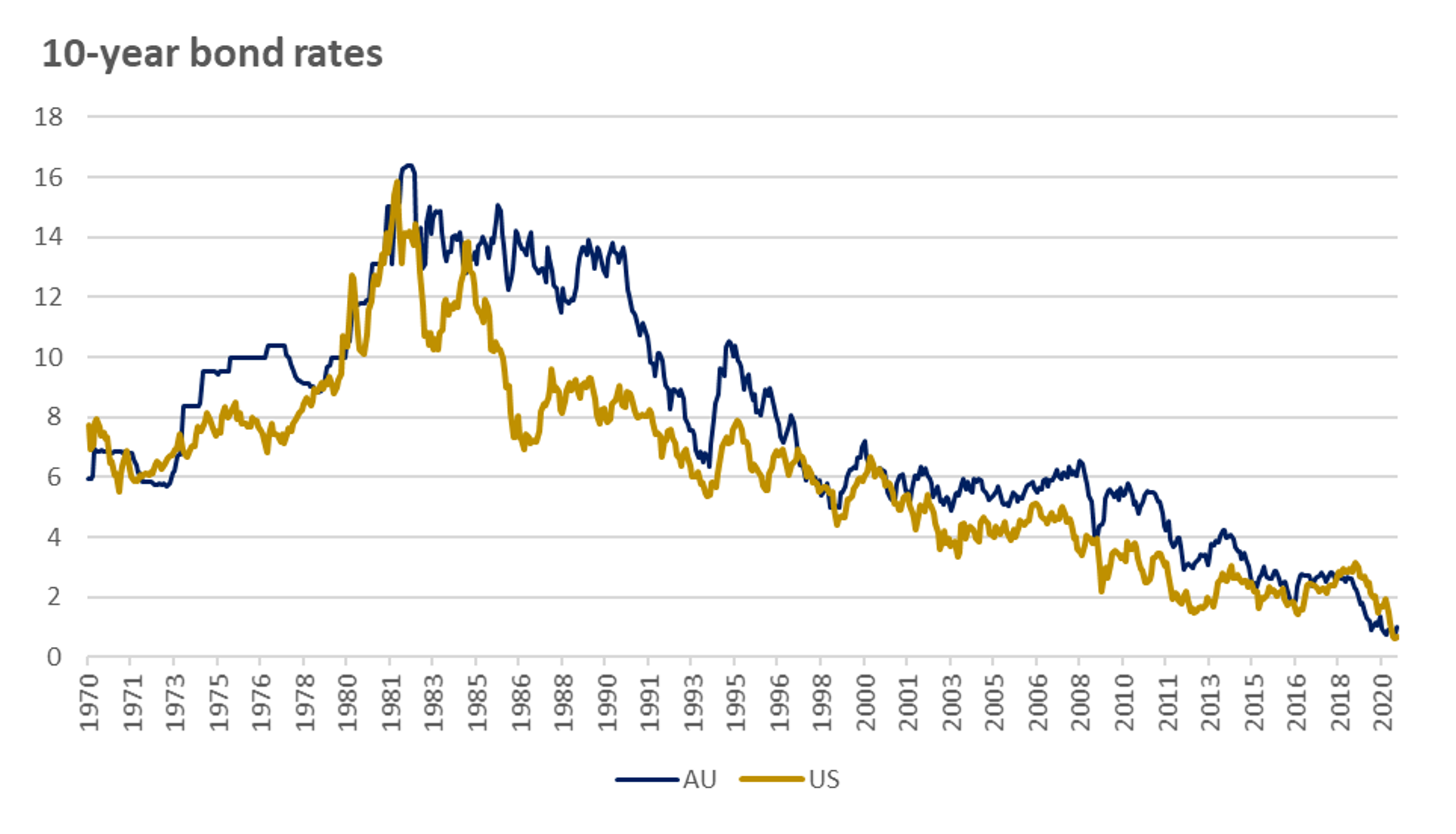

Current bond yields and prices haven’t been seen in Australia since the 1890s and 1930s depressions. The market is being supported by foreign buyers and central bank liquidity.

Glynn's Take: Australian Government Bond Rally Could Fizzle - WSJ

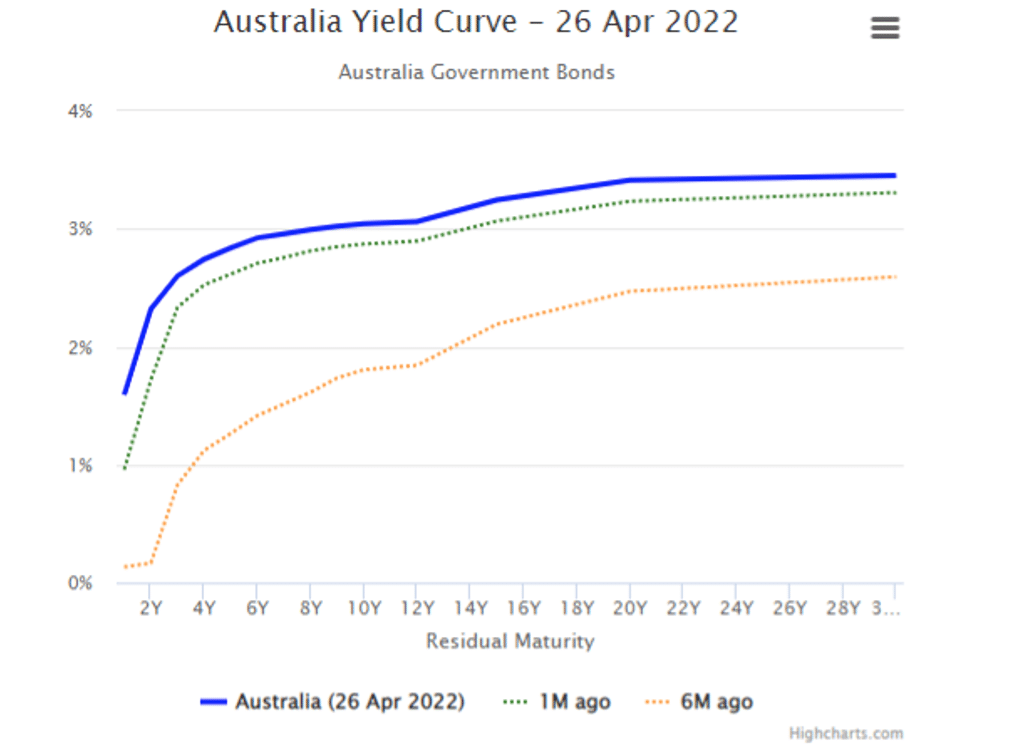

Australia's move to end yield curve control exposes the policy's flaws

What Is A Yield Curve? - Fixed Income News Australia

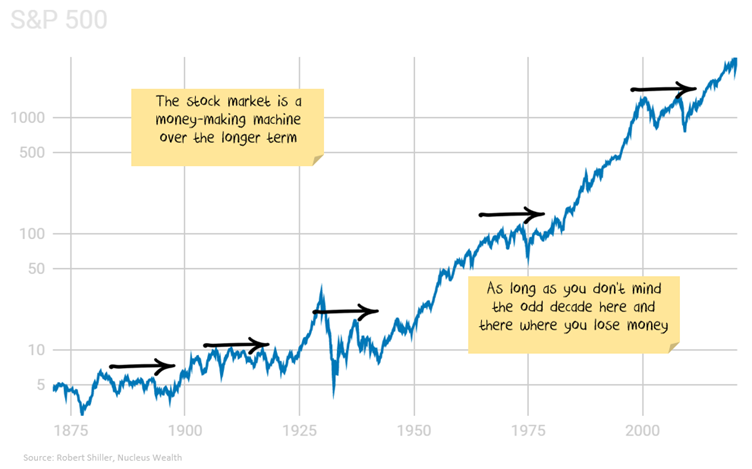

One last hurrah for the 60/40 portfolio?

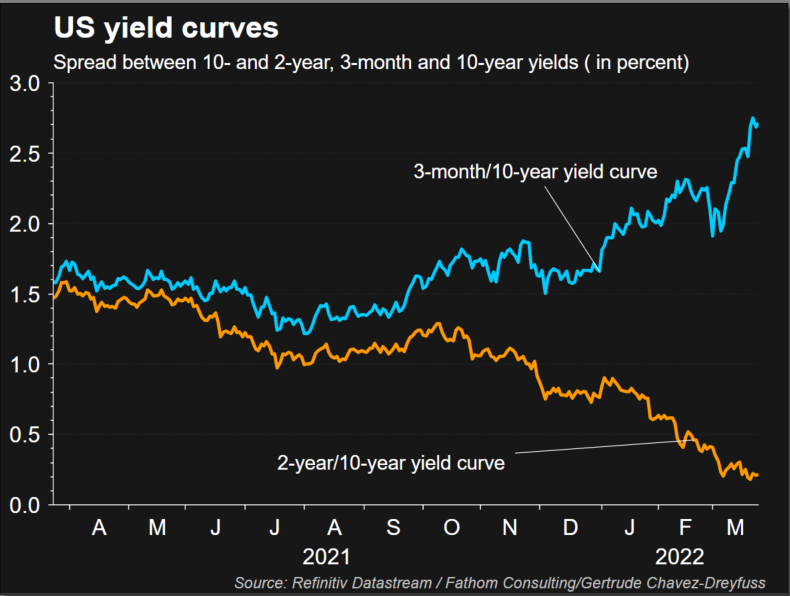

U.S. Treasury yield curve divergence sends mixed recession signals

Latest Articles, News & Analysis on bonds

Australia: 10-year bond yield 2023

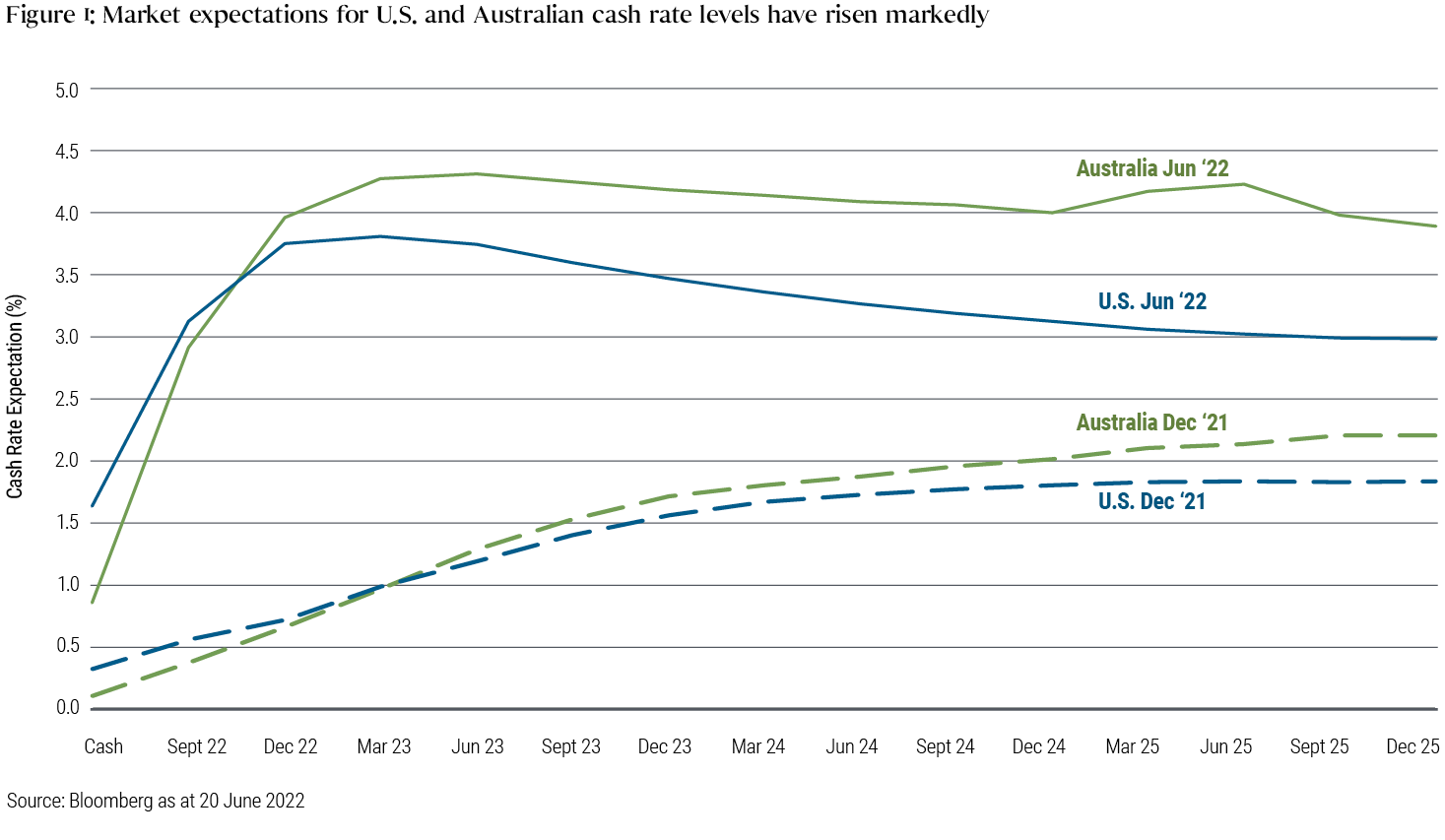

Australian Bond Yields Jump as Inflation Boosts Rate-Hike Bets - Bloomberg

One last hurrah for the 60/40 portfolio?

Bonds and the Yield Curve, Explainer, Education

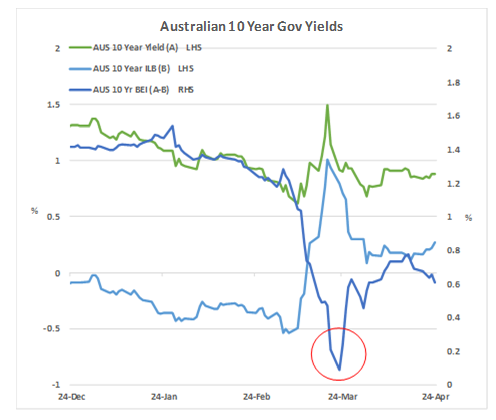

Inflation Linked Bonds 101 - Ardea Investment Management

What's happened to the 10-Year Government Bond Yield? - Bond Adviser

On the Up: What Do Rising Rates Mean for Bond Yields and Mortgages in Australia?

What do low interest rates mean for equity markets? « ROGER MONTGOMERY

GRAPHIC-Global bonds in July notch up best month since 2020 COVID meltdown

:quality(85)/http%3A%2F%2Fstatic.theiconic.com.au%2Fp%2Fbonds-7673-3517391-1.jpg)